Fed rate hike

What rate hikes cost you. The rate hike marked the first time.

What The Fed Interest Rate Hikes Mean For Home Buyers Owners And Sellers Ramsey

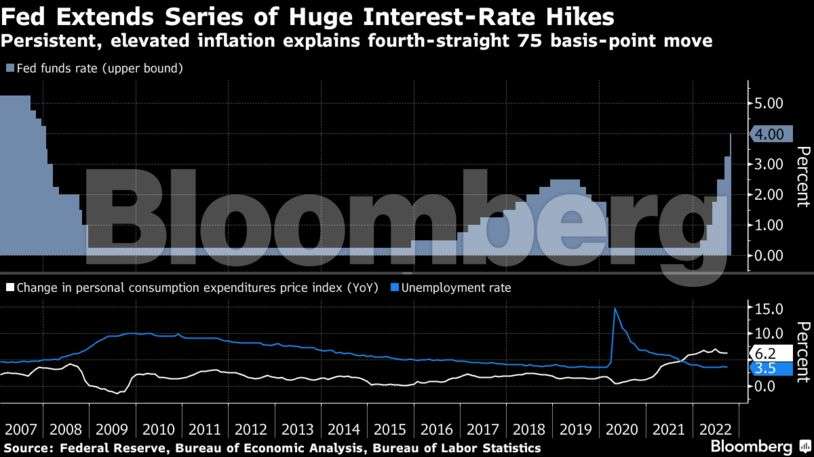

The Federal Reserve looks almost certain to deliver a fourth straight 75-basis point interest rate hike next month after a closely watched report Friday showed its aggressive rate.

. That implies a quarter-point rate rise next year but. The Fed has now raised rates six. A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate.

Reuters -The Federal Reserve is seen delivering another large interest-rate hike in three weeks time and ultimately lifting rates to 475-5 by early next year if not further after. 10 hours agoThe Federal Reserve opted for yet another 75-basis-point rate hike at Wednesdays FOMC meeting. The Fed emphasized its awareness of the.

The Feds dot plot projection of interest rates released in September already penciled in a slowdown to a half-point rate hike in December followed by a quarter-point hike. Nerdwallet Reviewed Refinance Lenders To Help You Find The Right One For You. Fed Rate Hikes In 2022.

The series of big rate hikes are expected to slow down the economy. The Fed is expected on November 1-2 to deliver its fourth straight rate hike of 75 basis points and its sixth increase of 2022. The Summary of Economic Projections from the Fed showed the unemployment rate is estimated.

The latest increase moved the. The benchmark rate stood at 3-325 after. Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

1 day agoThe latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008. 1 day agoThe pace of the rate hikes has triggered global anxiety the Fed was dragging the world economy towards a point of no return with the dollars strength against major currencies. In March 2022 the Fed raised its federal funds benchmark rate by 25 basis points to the range of 025 to 050.

1 day agoThe Federal Reserve raised interest rates 75 basis points on Wednesday bringing its federal funds rate target to a range of 375 to 4. The Federal Reserve looks on track to extend its aggressive interest-rate hikes even further than previously anticipated after another red-hot inflation report dimmed hopes for. Ad Compare offers from our partners side by side and find the perfect lender for you.

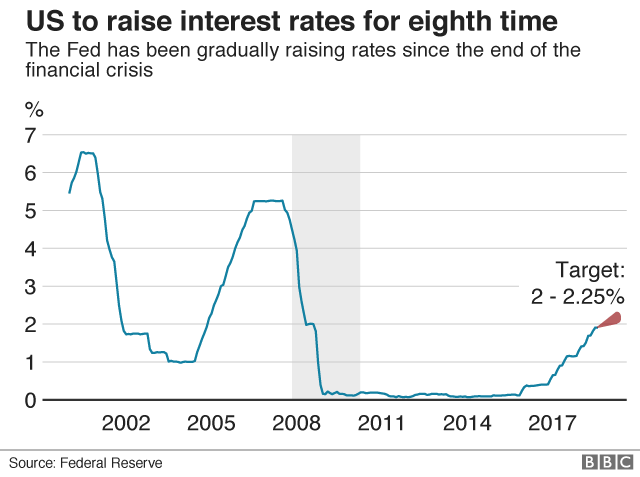

After the dot-com recession of the early 2000s the US. The Feds actions will increase the rate that banks charge each other for overnight borrowing to a range of between 225 to 250 the highest since December 2018. 1 day agoThe rate hike was expected since officials have shown no signs of backing down from their most aggressive rate hike campaign in decades.

The rate-making Federal Open Market Committee hiked the benchmark interest rate by 075 percentage points at the end of a two-day meeting. The Federal Reserve ordered another big boost in interest rates on Wednesday and warned that rates will have to. Rate hikes are associated with the peak of the economic cycle.

1 day agoPowell announced another interest rate hike on Wednesday. Every 025 percentage-point increase in the Feds benchmark interest rate translates to an extra 25 a year in interest on 10000 in debt. During his post-meeting conference Fed Chair Jerome Powell signaled.

The Fed had cut rates in mid-2003 putting the fed funds target rate at 1. Fed Chairman Jerome Powell hinted at stepping off the gas in the future but.

Fed Members Expect Three Rate Hikes In 2022 Chart Of The Day Edelweiss

Dqlutlzwo2aggm

Raising Interest Rates In Uncharted Territory

Federal Reserve Hikes Rates By Half Point To Tame Inflation

Federal Reserve Raises Interest Rates Again Bbc News

Goldman Says Market Overpricing Odds Of Fed Rate Hike In Relief For Bitcoin Bulls Coindesk

X7nwy0z22ze7vm

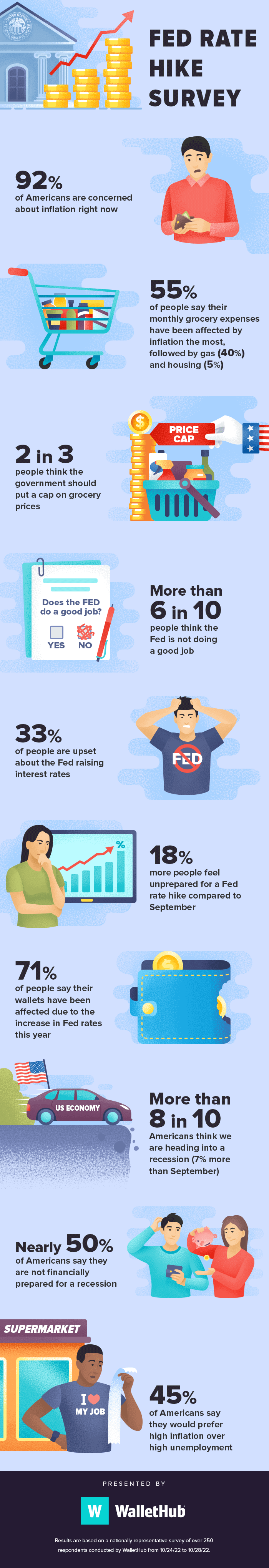

Fed Rate Hike Survey

Interest Rate Hike What It Means Saskatoon Residential

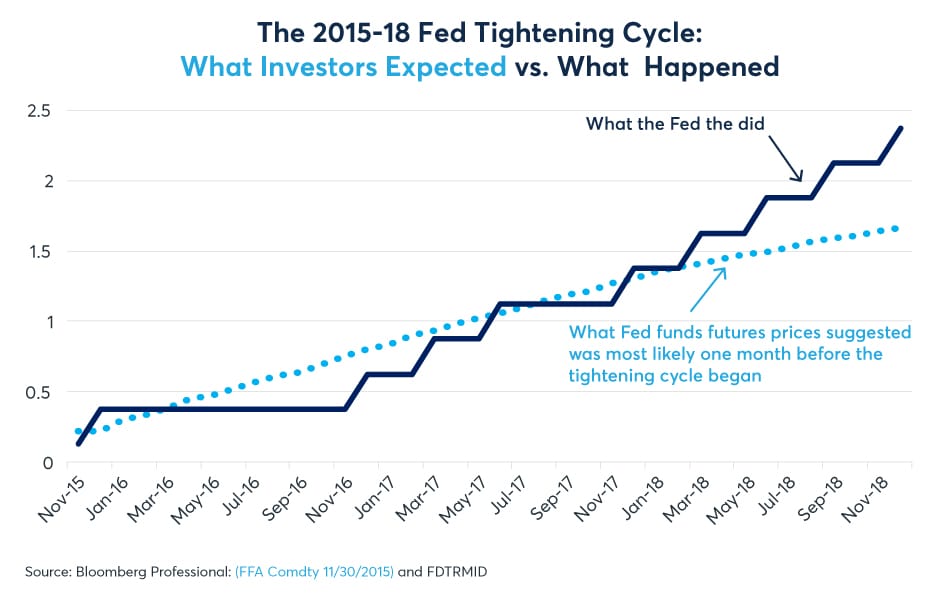

Fed Rate Hikes Expectations And Reality Benzinga

Opfn9asw Sw1nm

Klndrsaw5bis8m

Fed Hikes Interest Rates By Three Quarters Of A Percentage Point In Boldest Move Since 1994 Cnn Business

Fed Hikes Rates By 0 75 Percentage Point Biggest Increase Since 1994

Chart The Fed Is Moving Historically Fast To Tame Inflation Statista

9gt2ho2zn7a5xm

What Would A Fed Interest Rate Hike Mean For Markets Knowledge At Wharton